Navigating the Watchlist: A Deep Dive into Inventory Choice and Monitoring

Associated Articles: Navigating the Watchlist: A Deep Dive into Inventory Choice and Monitoring

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Navigating the Watchlist: A Deep Dive into Inventory Choice and Monitoring. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Navigating the Watchlist: A Deep Dive into Inventory Choice and Monitoring

The fun of investing usually hinges on figuring out the subsequent huge winner. Whereas no technique ensures success, constructing and actively managing a watchlist is a vital element of a profitable funding method. A watchlist is not only a random assortment of shares; it is a curated record of corporations that meet particular standards, warrant additional investigation, and probably characterize enticing funding alternatives. This text explores the intricacies of making, sustaining, and leveraging a watchlist to boost your funding technique.

Defining Your Funding Objectives and Standards:

Earlier than diving into the specifics of inventory choice, it is paramount to outline your funding objectives and danger tolerance. Are you a long-term investor targeted on regular development, or do you favor a extra aggressive, short-term method? Your funding horizon considerably impacts the varieties of corporations it is best to embody in your watchlist.

For instance, a long-term investor may prioritize corporations with robust fundamentals, constant earnings development, and a historical past of dividend funds. Conversely, a short-term dealer may give attention to shares with excessive volatility, robust momentum, or these reacting to particular information occasions.

As soon as your funding objectives are established, you possibly can outline particular standards on your watchlist. These may embody:

- Business: Specializing in particular sectors (know-how, healthcare, power, and so forth.) permits for specialised analysis and a deeper understanding of market dynamics.

- Market Capitalization: Massive-cap, mid-cap, and small-cap shares carry completely different ranges of danger and potential reward.

- Monetary Metrics: Key ratios like Value-to-Earnings (P/E), Value-to-E book (P/B), Return on Fairness (ROE), and debt-to-equity ratios present insights into an organization’s monetary well being and valuation.

- Progress Potential: Search for corporations with robust income development, increasing market share, and progressive services or products.

- Dividend Yield: For income-focused traders, dividend yield is a vital issue.

- Technical Indicators: Technical evaluation makes use of chart patterns and indicators (e.g., shifting averages, RSI) to determine potential entry and exit factors.

Sources for Figuring out Watchlist Candidates:

Quite a few assets can assist you determine promising shares on your watchlist:

- Monetary Information and Media: Respected sources just like the Wall Avenue Journal, Bloomberg, Reuters, and monetary information web sites present invaluable insights into market developments and particular person firm efficiency.

- Monetary Screening Instruments: Platforms like Yahoo Finance, Google Finance, and devoted inventory screeners help you filter shares primarily based on particular standards, making it simpler to search out corporations that match your funding objectives.

- Brokerage Platforms: Most brokerage accounts provide built-in screening instruments and analysis assets.

- Firm Filings (SEC EDGAR): For in-depth evaluation, evaluate corporations’ 10-Ok (annual reviews) and 10-Q (quarterly reviews) filings to achieve a complete understanding of their monetary efficiency and enterprise technique.

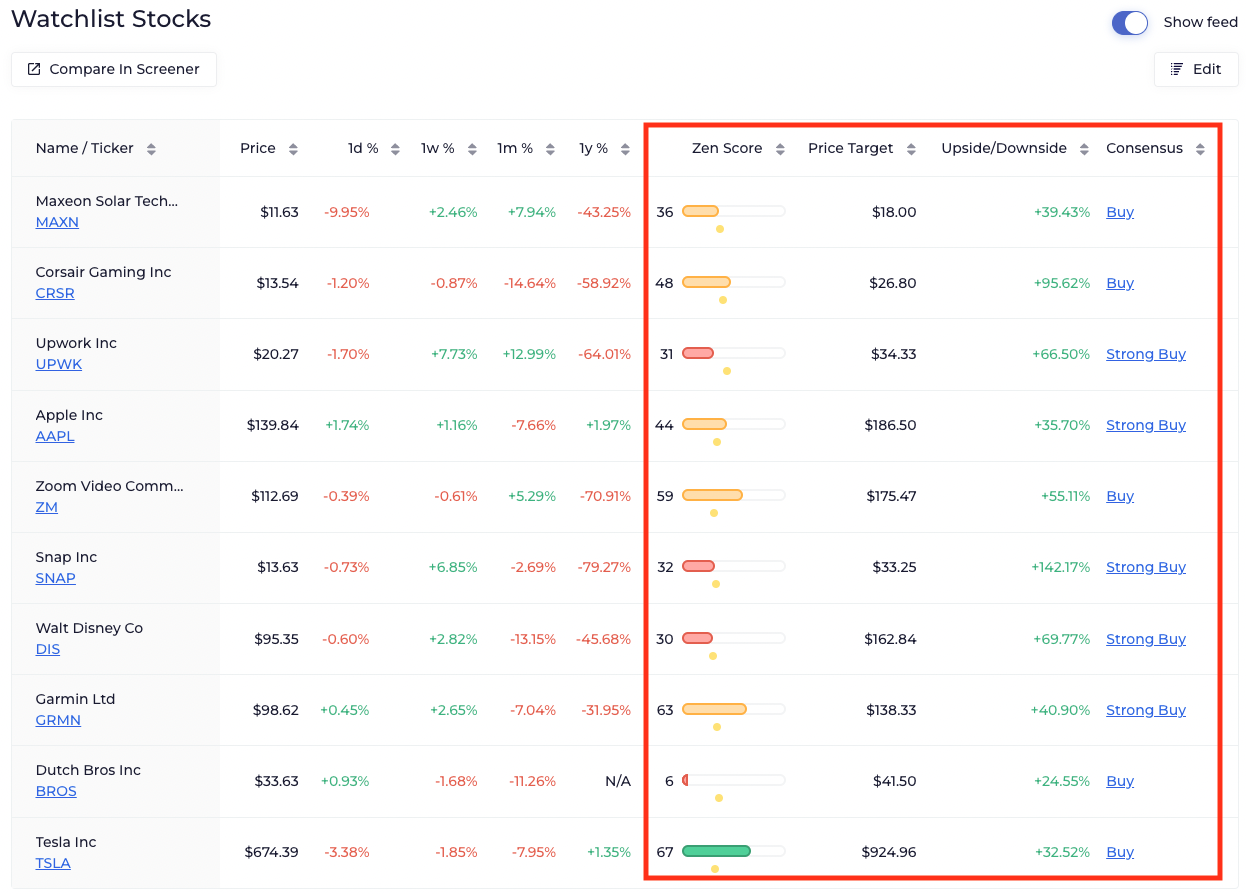

- Analyst Rankings and Reviews: Whereas not foolproof, analyst rankings and reviews can provide invaluable views on an organization’s prospects. Nevertheless, it is essential to conduct your individual unbiased analysis.

- Business-Particular Publications: Specialised publications and journals provide in-depth evaluation of particular industries, offering invaluable insights for focused investing.

Analyzing Shares for Your Watchlist:

As soon as you’ve got recognized potential candidates, thorough evaluation is essential earlier than including them to your watchlist. This includes:

- Basic Evaluation: Assess the corporate’s monetary well being, aggressive panorama, administration staff, and long-term development prospects. Analyze monetary statements, evaluate trade reviews, and perceive the corporate’s enterprise mannequin.

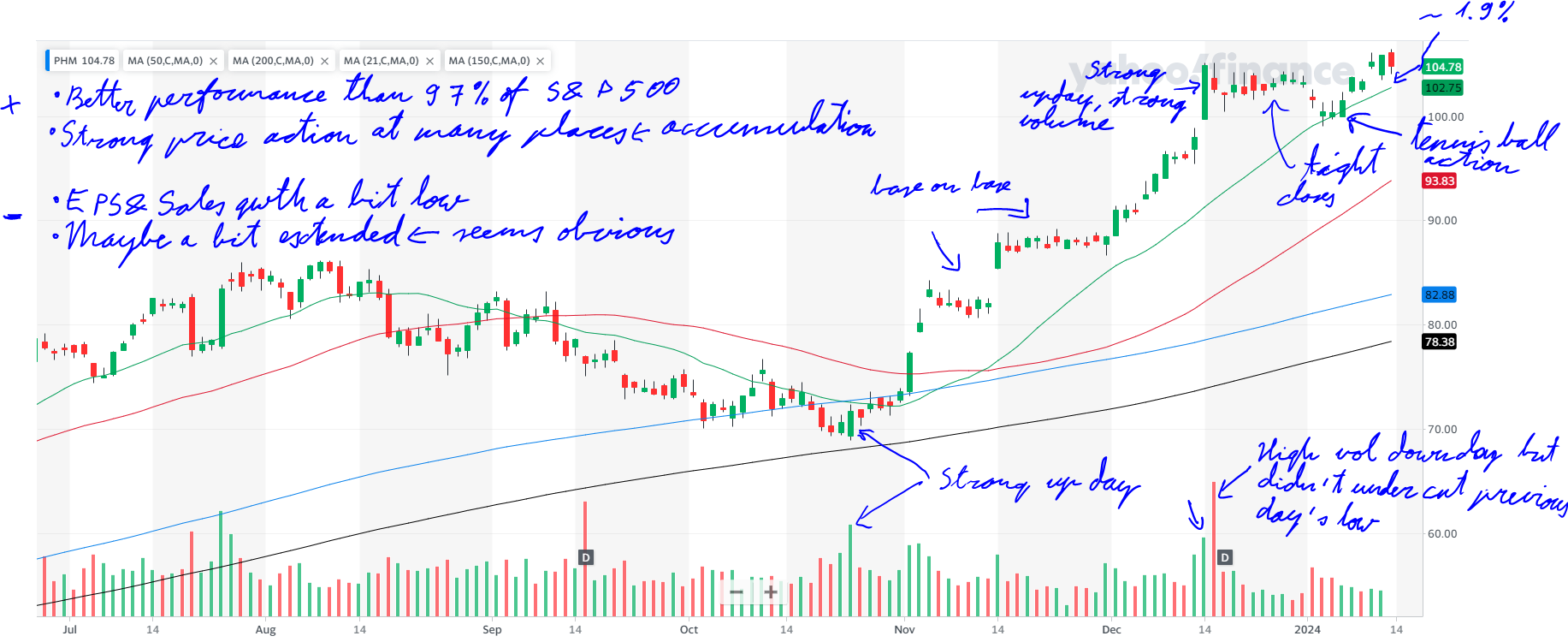

- Technical Evaluation: Study the inventory’s worth chart to determine developments, assist and resistance ranges, and potential buying and selling indicators. This includes utilizing varied indicators and chart patterns to gauge momentum and potential worth actions.

- Qualitative Evaluation: Take into account components past numbers, equivalent to the corporate’s status, model power, buyer loyalty, and innovation capabilities. Learn information articles, analyst reviews, and firm press releases to collect qualitative data.

- Threat Evaluation: Consider the potential dangers related to investing in every firm. Take into account components like trade competitors, regulatory modifications, financial situations, and geopolitical occasions.

Managing Your Watchlist Successfully:

A well-managed watchlist is dynamic and requires common updates. Listed below are some key features of efficient watchlist administration:

- Common Overview: Periodically evaluate your watchlist to take away corporations that now not meet your standards or have considerably deteriorated in efficiency.

- Notice-Taking: Preserve detailed notes on every firm, together with your rationale for including it to the watchlist, key monetary metrics, and your funding thesis.

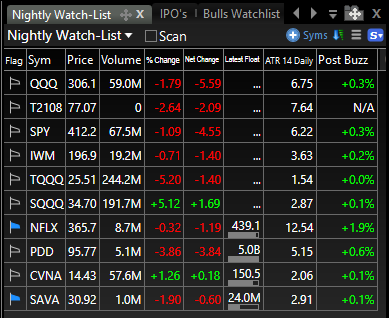

- Alert Techniques: Make the most of alert techniques supplied by your brokerage platform or monetary information web sites to be notified of great information occasions or worth actions affecting corporations in your watchlist.

- Diversification: Keep away from over-concentrating your watchlist in a single sector or a small variety of corporations. Diversification helps mitigate danger.

- Emotional Self-discipline: Keep away from impulsive choices primarily based on short-term market fluctuations. Persist with your funding technique and standards when making funding choices.

Examples of Watchlist Shares and Their Evaluation (Hypothetical):

Let’s contemplate three hypothetical examples as an instance the method:

1. Progress Tech Inventory (Instance: InnovateTech Inc.):

- Rationale: Excessive development potential within the AI sector, robust income development, progressive product pipeline.

- Basic Evaluation: Excessive P/E ratio reflecting excessive development expectations, robust money circulate, growing market share.

- Technical Evaluation: Inventory worth consolidating after a latest rally, potential breakout above resistance degree.

- Threat Evaluation: Excessive valuation, dependence on technological developments, intense competitors.

2. Worth Inventory (Instance: Dependable Manufacturing Corp.):

- Rationale: Undervalued primarily based on elementary metrics, constant dividend funds, robust stability sheet.

- Basic Evaluation: Low P/E ratio, excessive dividend yield, secure earnings development.

- Technical Evaluation: Inventory worth buying and selling close to long-term assist degree, potential for worth appreciation.

- Threat Evaluation: Sluggish development potential in comparison with development shares, sensitivity to financial downturns.

3. Rising Market Inventory (Instance: International Assets Ltd.):

- Rationale: Publicity to a quickly rising rising market, potential for top returns, strategic partnerships.

- Basic Evaluation: Excessive development potential, but additionally increased danger resulting from market volatility and political uncertainty.

- Technical Evaluation: Inventory worth displaying robust momentum, but additionally susceptible to vital worth swings.

- Threat Evaluation: Geopolitical dangers, foreign money fluctuations, regulatory uncertainties.

Conclusion:

Constructing and managing a watchlist is an ongoing course of that requires self-discipline, analysis, and a transparent understanding of your funding objectives. By rigorously choosing corporations primarily based on outlined standards and conducting thorough evaluation, you possibly can considerably enhance your probabilities of figuring out promising funding alternatives. Keep in mind that a watchlist is a device to help your funding choices, not a assure of success. All the time conduct your individual due diligence and contemplate searching for recommendation from a certified monetary advisor earlier than making any funding choices. The important thing to success lies in steady studying, adaptation, and a well-defined funding technique.

Closure

Thus, we hope this text has offered invaluable insights into Navigating the Watchlist: A Deep Dive into Inventory Choice and Monitoring. We hope you discover this text informative and helpful. See you in our subsequent article!